Insider Intelligence projects its share of US e-commerce sales will increase from 39.8% in 2020 to 40.4% in 2021 with sales of $367.19 billion—a 15.3% increase YOY. Walmart and Target are growing fast, but Amazon is still growing faster. Prime Day happened on June 21–22 with 24.9% of consumers purchasing in the Health & Beauty category, according to reporting from Numerator.

Vanessa Kuykendall, VP of Business Development at Market Defense, shared insight on Prime Day: "Premium Beauty ran a 30% off offer on all their brands, but that didn't seem to move any brands or products into the top 25. Mass Beauty still beats out Prestige at Prime Day due to price promotions and reseller competition driving down price. If Prestige brands want meaningful returns on their promotions on Prime Day, they have to lock down their buy box. If they allow a rogue reseller to sneak in with a lower price, all their work planning and preparing goes to waste."

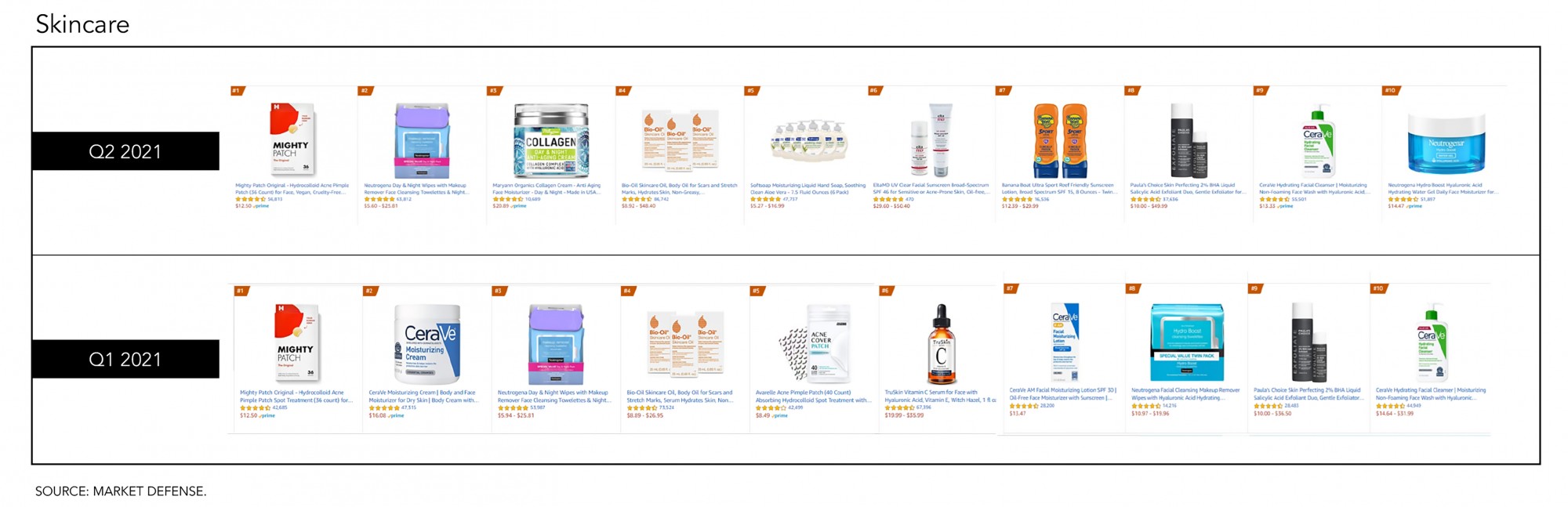

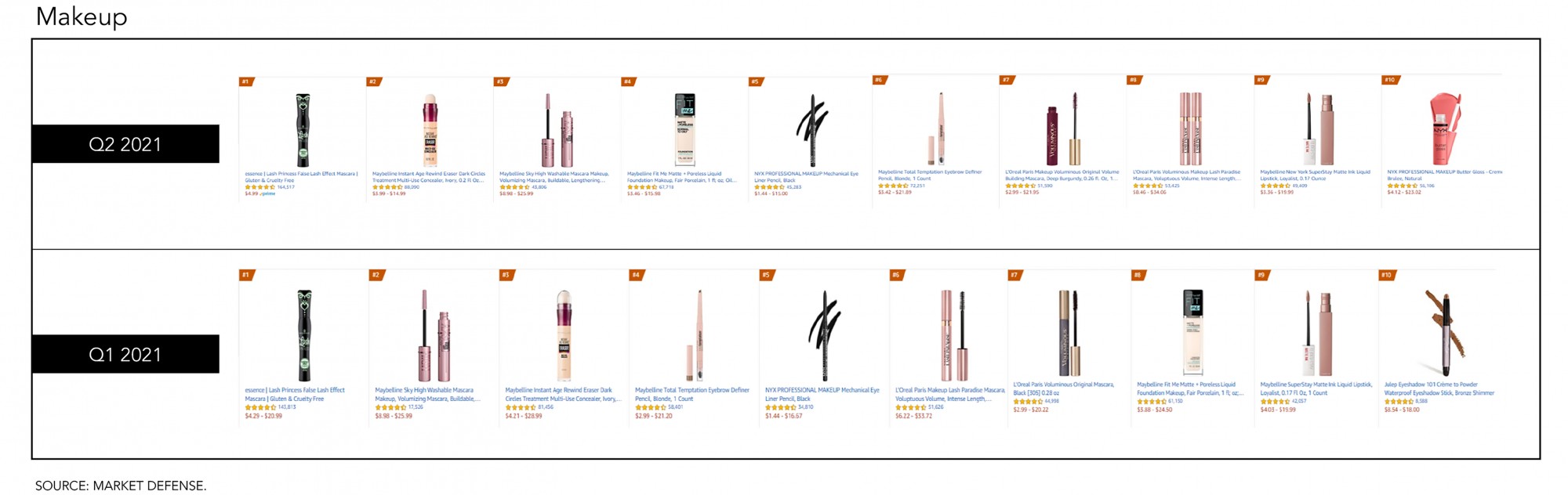

Amazon's Top 25 in Beauty & Personal Care has experienced a lot of shifts this quarter, which may have been impacted by Prime Day promotion, but changes also reflect our changing lifestyles. Pandemic-related products like masks, acne remedies, and hand soap have exited the list. In contrast, sunscreen and men's grooming have entered, possibly related to travel, weather, and men going back to the office. Skincare and foundation makeup continue to fill the top 25 but in new and lighter formulations.

Kuykendall commented, "Customers are shopping, discovering, and trying new things, which feels like a shift in the right direction."

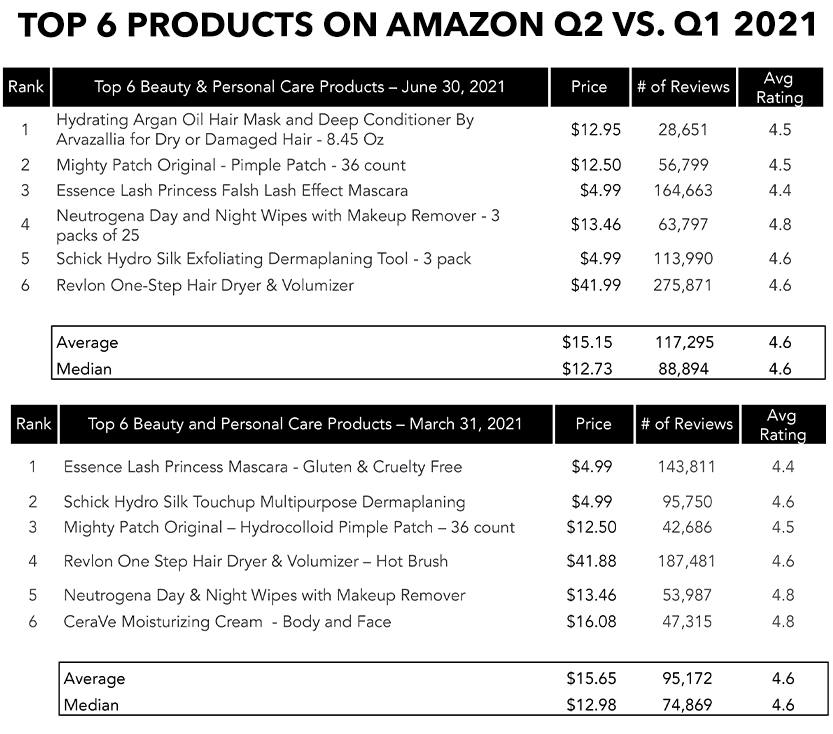

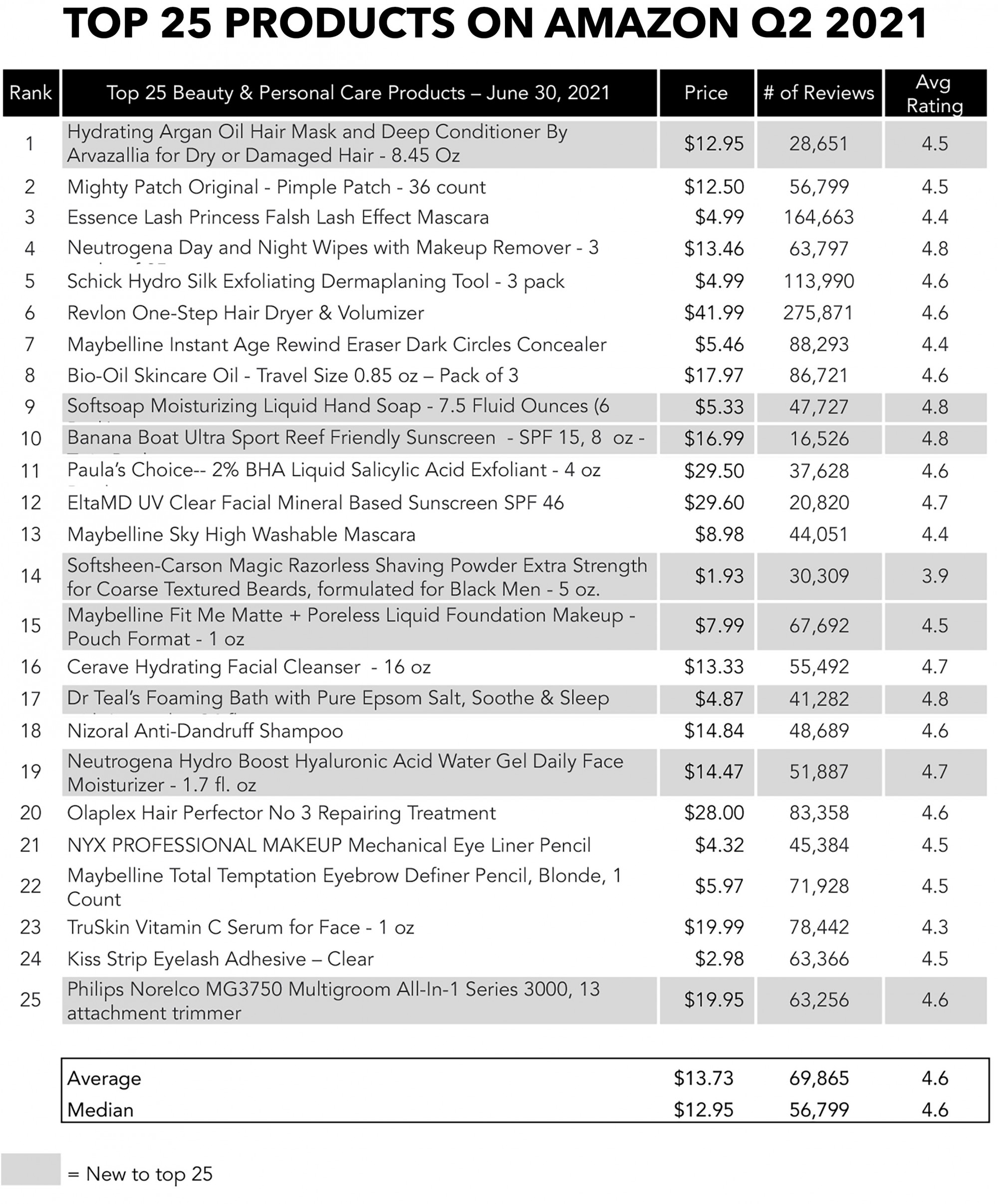

While the top 25 list is heavily weighted to mass products with the average price point falling to $13.73 in Q2 from $14.24 in Q1, a handful of brands represent prestige beauty. Mighty Patch Original – Hydrocolloid Pimple Patch - 36 count moved up from the #3 to #2 position this quarter. Paula's Choice – 2% BHA Liquid Salicylic Acid Exfoliant - 4 oz Bottle (#11 spot) and EltaMD UV Clear Facial Mineral Based Sunscreen SPF 46 (#12 spot) both moved up the ranking and are on the verge of cracking the top 10. Olaplex Hair Perfector No 3 Repairing Treatment, on the other hand, lost ground this quarter, falling four spots to #20 from #16.

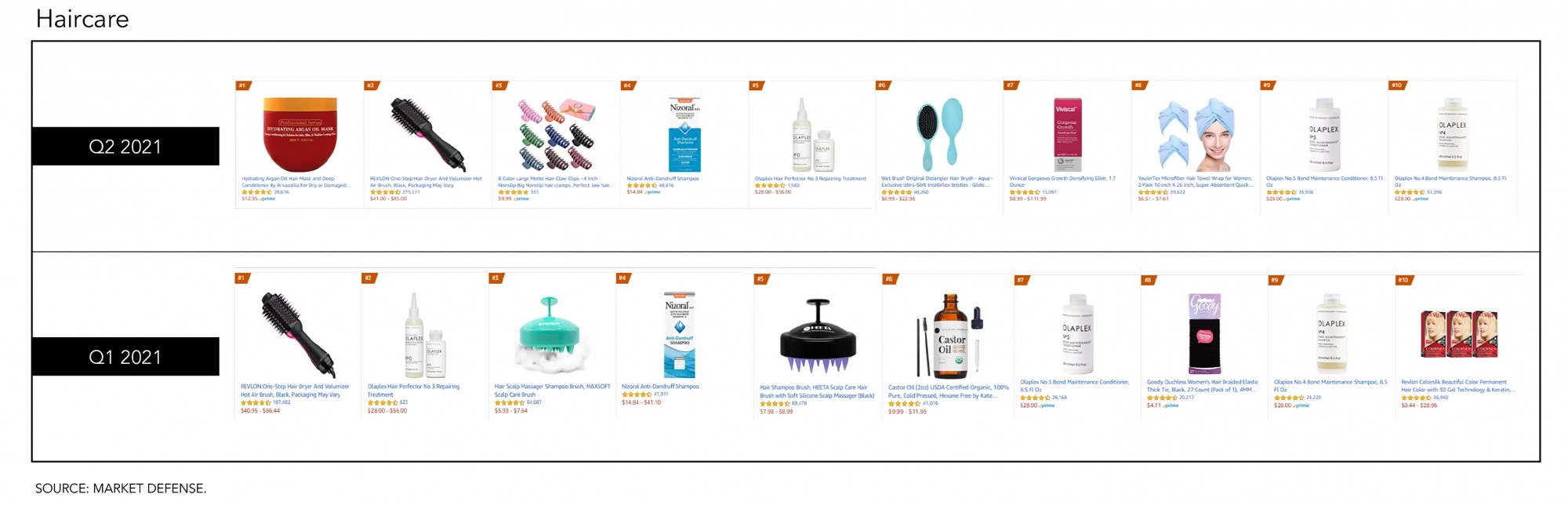

Q2 saw eight new entrants to the top 25 Beauty & Personal Care Product list. Arvazallia's Argan Oil Hair Mask entered the list this quarter sweeping the #1 selling spot. Long loved by influencers, this professional brand has been an Amazon favorite for years and knocked Essence Lash Princess Mascara - Gluten & Cruelty Free out of the top spot.

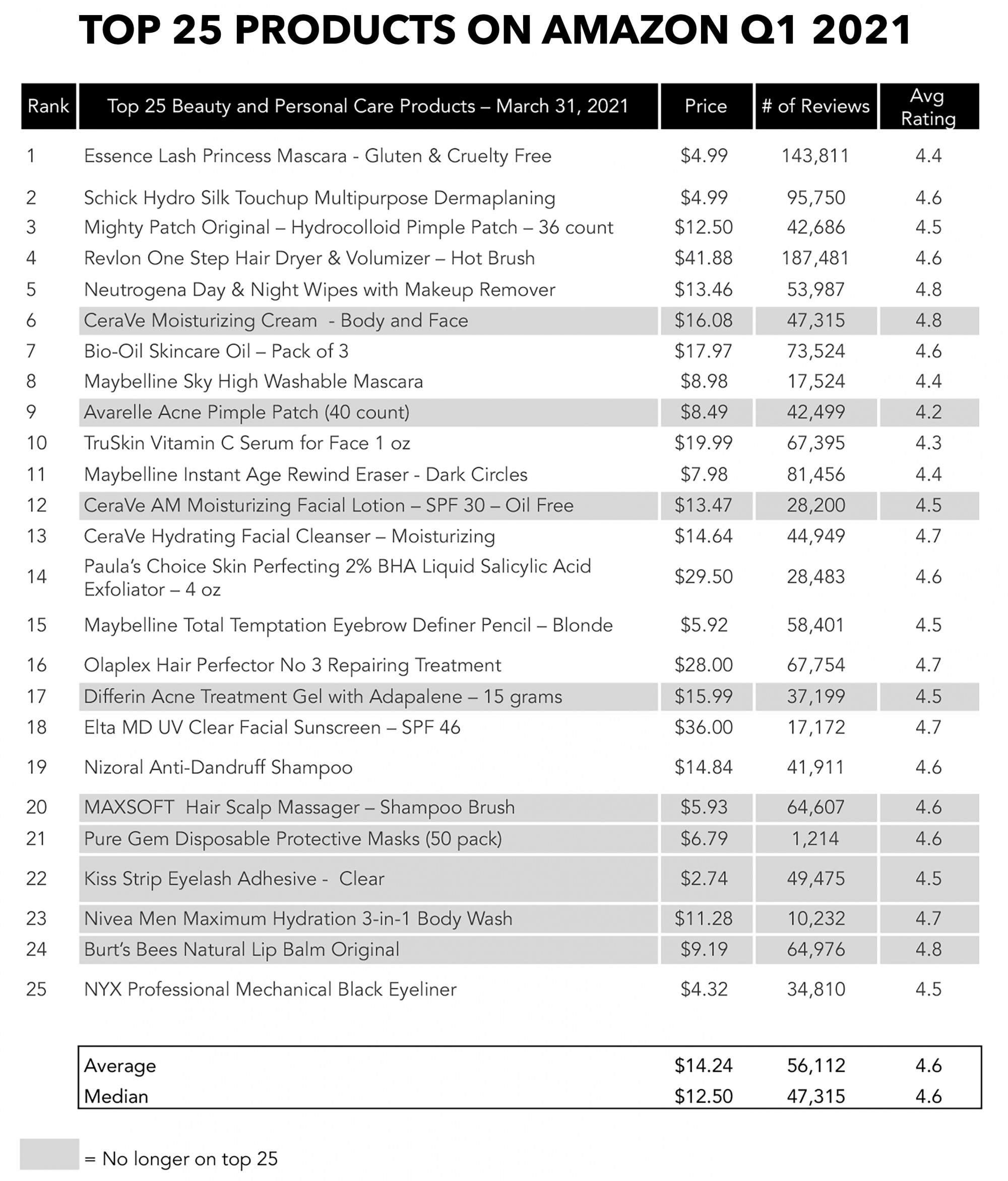

TikTok continues to help catapult brands into Amazon's top 25 rankings, but do sales last? TikTok darling CeraVe had a handful of products crack Q1's top 25 that have fallen off Q2's rankings. CeraVe Moisturizing Cream – Body and Face held the #6 spot with CeraVe AM Moisturizing Facial Lotion – SPF 30 Oil Free taking #12 in Q2, but neither brand made the cut this quarter. CeraVe Hydrating Facial Cleanser – Moisturizing remains on the list but fell three notches, holding the #16 spot in Q2. A TikTok push may be a great short-term visibility tool that provides a revenue bump, but it may not result in long-term sales.

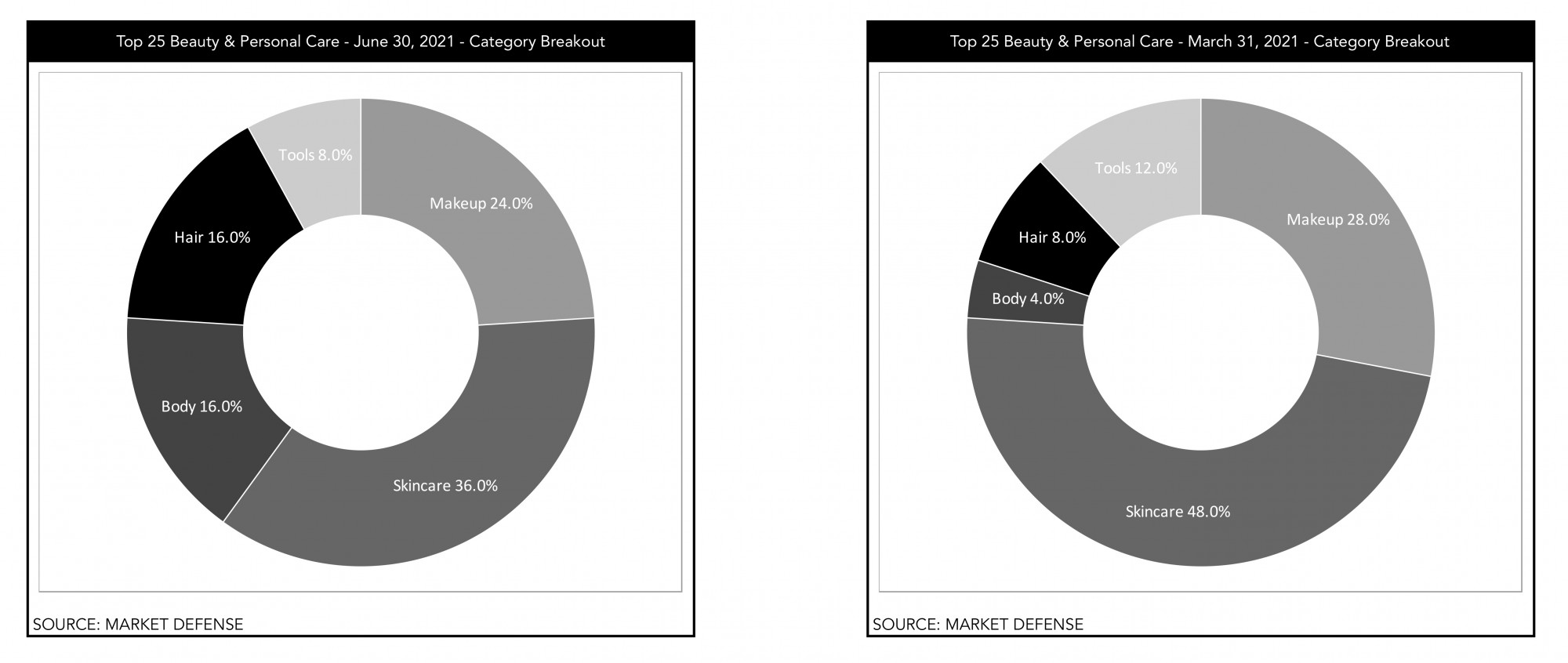

There were significant shifts from a category perspective: Q2 saw skincare lose significant ground, seeing a -12% drop. At the same time, haircare doubled and body saw significant growth, likely bolstered by the seasonal sales of sunscreen.

"Also dropping off the list entirely were at home hair color and manicure tools. With little or no access to their trusted beauty experts, consumers had to learn how to take care of themselves during the pandemic, and now salons and spas have opened,” Kuykendall commented. "But I think the beauty consumer may not want to give up control just yet; I think they are more confident in their own skills than ever and we’ll see a rise in beauty gadget and skin treatment sales.”

She continued, "I believe we will see a beauty boom in the next year with a focus on healthy skin with minimal makeup, and consumers will embrace the beauty technology and products that supports that."

Reference: Q1 Amazon Top 25 Beauty & Personal Care