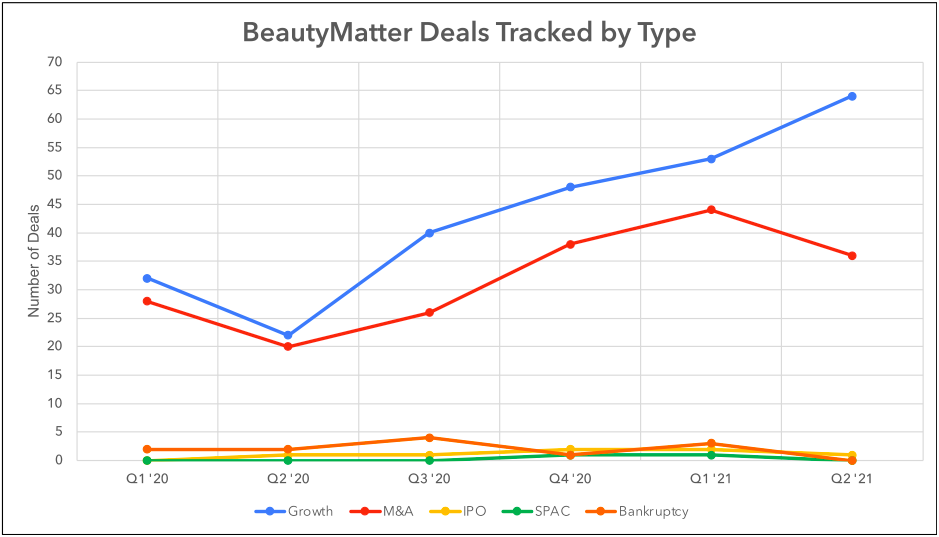

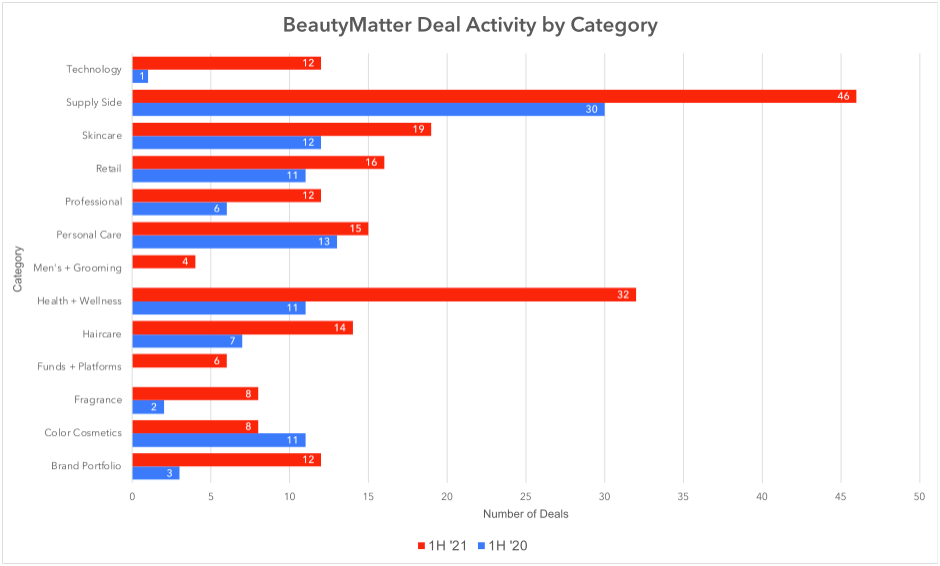

Earlier this year, in BeautyMatter’s 2020 Year End Investment + M&A Report, Jorge Cosano of Synchronicity Ventures predicted that 2021 would shape up to be a boom for growth investments in beauty and wellness. Cosano predicted deal activity would be driven by an abundance of capital and the “seeding ground” of COVID emergence for new ideas and concepts. Based on BeautyMatter’s Q2 2021 report, investment and M&A activity during the first half of 2021 is proving that prediction to have been spot on, with beauty and wellness seeing robust deal flow, particularly as it relates to growth investments. BeautyMatter tracked 204 transactions in the first half of 2021, with growth investments (seed, venture, minority stakes) comprising 57% of deal activity and M&A (traditional mergers, acquisitions, and majority stakes) comprising 39%. In fact, deal activity during the first half of 2021 is already 74% of the total deals BeautyMatter tracked in all of 2019 (275 deals), largely considered to be a banner year for beauty and wellness transactions. So, what’s driving all of this activity in beauty and wellness and what are the key fundamentals behind some of the industry’s most talked about transactions? We assembled a panel of experts to help us help you make sense of it all.

But first, just the numbers.

Deal activity in the first half of 2021 has been dominated by growth transactions (seed, venture, and minority investments). First half deal activity is up 91% in 2021 versus 2020, reflecting strong investor interest in beauty and wellness as the US emerges from COVID. First half 2021 deal activity is double that of the first half of 2019, putting the industry on track to exceed pre-COVID deal volume.

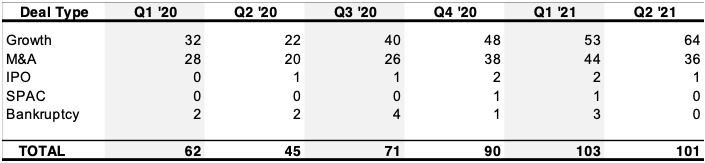

Supply side consolidation continues to be the primary driver of deal activity in 2021, but almost every category has shown growth, led by health and wellness, technology platforms, skincare, haircare, and fragrance. The notable exception has been color cosmetics, which has seen less deal activity in the first half of 2021 than in 2020, reflecting the impact of COVID-19 on the category.

Providing context, analysis, and expert insight.

To help us provide context to the data and to dig into some of the most talked about transactions and investment trends of 2021, we spoke to five beauty and wellness deal experts:

There have never been more paths available for a brand looking to raise capital or planning an exit. How has this changed the dynamics of the VC and PE ecosystem?

Jeff Mills: There has been a noteworthy proliferation of brands in the beauty space over the past decade, which has been driven in part by the ability to create awareness through digital marketing and social media reach, paired with asset-lite business models. This continuously increasing number of emerging indie brands in this highly attractive and replenishable category has attracted more VCs and PEs to the space, leading to an increase in the volume of capital raises as well as exits to strategic buyers, who have also remained highly active as they seek high-growth indie brands that complement and bring new consumers into their conglomerates. This shift has created an increasingly competitive environment for investors and strategic buyers, and the vast number of indie brands has made it more challenging to identify best-in-class “winners” that are differentiated and have long-term staying power with consumers. As such, it has become increasingly important for investors and strategics to spend time and resources doing more due diligence to identify a proven point of difference for a brand, supported by clear consumer loyalty, an engaged consumer following, strong/promising retail partnerships & a clear path for growth, among other qualities. This competitive environment has pushed up valuations, which held incredibly strong at high levels even during the height of the uncertain environment that COVID brought on.

Kelly McPhilliamy: The number of capital providers seeking to invest in independent brands has grown meaningfully in recent years, leading to more competition and specialization by these firms to differentiate themselves. The number of middle-market and larger PE funds backing beauty businesses grew over threefold in the last seven years. New earlier-stage investors have risen out of tech-focused VCs turning to beauty (particularly digital brands), and consumer PE professionals have begun starting their own funds to address a gap in the market. At the same time, more strategics have venture funds. While Unilever was the first, recently other strategics are taking a collaborative approach, such as Beiersdorf’s partnership with Tmall to invest in Chinese brands. Given low barriers to entry in beauty and an ability to scale quickly online, more investors and strategics are trying to identify and back winning brands early.

Rich Gersten: It has never been easier for good brands to attract capital. While the appetite for investment in beauty and wellness brands continues to increase, there are still very few institutional investors that are willing to write small checks (less than $5MM) and even fewer that have domain expertise and an investment track record in the beauty sector. This is the white space we saw at True Beauty Ventures and the reason we launched the firm last year. As brands get bigger, however, there are a larger number of PE funds interested in the category (greater than $15MM checks), driving competition for brands that are able to reach a certain scale. Strategics are much more difficult to transact with and it takes a special brand with compelling growth and business characteristics to attract them. While strategics continue to be active, brands must recognize that a strategic sale can be very difficult to successfully execute.

William Susman: Really little has changed. Billion-dollar SPACs aren’t buying $100 million growth brands, so, the fundamentals of raising capital remain in place and very strong.

Ilya Seglin: The only dynamic that has evolved over the past 3-4 years is the emergence of PE firms that are truly focused on small brands and have expertise in the sector (Prelude, True Beauty Ventures, Waldencast, CULT Capital, etc.). I never felt the VC world was appropriate for the beauty sector, but these PE firms are addressing a real need in the ecosystem.

Marissa Lepor: Although there’s about $1.9 trillion of dry powder globally, there’s also an unprecedented number of indie beauty brands at various stages of their growth trajectories seeking strategic capital. As such, competition for the best assets remains fierce, driving up valuations of industry-disrupting businesses with strong and authentic brand stories, engaged consumers, and robust financial profiles. These assets continue to command unprecedented valuations, creating barriers to entry for investors with fewer beauty credentials, while simultaneously establishing a difficult dynamic for investors pursuing less mature brands that might not deserve industry-leading valuations.

Color cosmetics is the only category we track that has shown less deal activity in the first half of 2021 vs. 2020. When do you think color will begin to catch investor attention again? Are the most compelling opportunities among smaller, growth brands or with large, established players?

Ilya Seglin: In the color cosmetics category, we have an interesting dynamic: brands that have done well over the past 12-18 months either took on investors right before COVID (Westman Atelier, ILIA, Dragun Beauty) or were launched with significant backing from the outset (Rare Beauty). And given significant growth in their own, profitable DTC businesses, there may be less of an immediate need for additional capital. On the other hand, investors looking for more scaled opportunities in color want to see evidence of sustained performance, which if you are a large brand with diverse distribution, has been more difficult to demonstrate in recent months. Add to that the working capital intensity of the color category and you end up with more investors taking a wait-and-see attitude rather than jumping in. As we look ahead, most activity will concentrate around smaller indie brands, or indie brands that are starting to grow up and will need additional capital to accelerate growth. Large, established players are only growing in their irrelevance, so the dynamic I expect is with multinationals either trying to sell some brands (but who is there to step up to catch a falling knife?) or looking for acquisitions to compensate for declining growth.

Clarisonic, Becca, and Rodin Olio Lusso—all hot indie beauty brands acquired by strategics not that long ago to tap into one trend or another—all recently shuttered. Do you have insight into why these brands were shut down as opposed to being sold? Do you expect to see more of this?

Jeff Mills: While strong social media has become a platform that has allowed new emerging brands to enter the industry, social media has also indirectly led to increasing pressure on existing brands to innovate at a pace that can be very difficult to manage operationally. Consumer expectations and appetite for newness is fueled by constantly seeing innovation through social media lens and this can decrease consumer loyalty to one brand. As such, consumer behavior and the complications of managing the competitive environment will likely continue to drive some brands to discontinue. While they may have considered a sale vs. a shut down, buyers are getting smarter about the competitive dynamics in this category today, and it has become more apparent how challenging it is to re-ignite momentum in brands with decreasing revenue trends.

Kelly McPhilliamy: Given the rise of multi-brand beauty platforms and investor interest in beauty, it is somewhat surprising that these brands weren’t marketed in a sale process rather than shuttered. With that said, it is notable how much portfolio optimization has been happening in beauty, including creative moves like Coty’s majority sale of Wella to KKR and Shiseido’s JV with CVC on its personal care business. Strategics are focusing their strategies and aligning resources with their strengths and where they can win.

Rich Gersten: I was surprised to see them shuttered before exploring a potential divestiture. I am not sure what goes into that analysis or decision, other than the parent may repurpose some of the formulas into other brands which they would be unable to do if divested. Or the costs to shutter may be better than keeping them alive to sell. Some parent companies may be more prone to divest (e.g., Shiseido) than others (e.g., L’Oréal and Estée Lauder). There are clearly brands for all of them that could be divested or sold as they rationalize portfolios, which is a normal process they all must undergo.

William Susman: I think many of these brands found success while still small, independent, and founder led. Transferring that brand DNA to a large, corporate strategic can prove to be very complicated.

Marissa Lepor: The recent shuttering of Clarisonic (acquired by L’Oréal in 2011), Rodin Olio Lusso (acquired by Estée Lauder in 2014), and Becca (acquired by Estée Lauder in 2016) were unfortunate but very much industry anomalies. Each business struggled for a myriad of reasons, but all were shut down before the brands lost significant value. L’Oréal and Estée Lauder likely analyzed potential strategic opportunities for each brand and decided upon what they believed would be the best option. I do not believe the shuttering of Clarisonic, Becca, and Rodin Olio Lusso sets any sort of precedent for more brand closures in the future. Strategics will continue to evaluate the performance of each brand in their respective portfolios and will do what’s best for their strategic vision and corporate strategy.

Three of the most buzzed-about deals during the quarter were Unilever’s acquisition of Paula’s Choice, Carlyle’s acquisition of Beautycounter, and THG Ingenuity’s acquisition of Bentley Labs. Although specific details were sparse, it’s been rumored that all commanded very high premiums. Do you have any thoughts or insights into these deals?

Jeff Mills: I think THG’s acquisition of Bentley Labs surprised many given they had not previously owned a skincare-focused manufacturer and seemed more focused on their front-end businesses. On the other hand, you have two branded transactions in Paula’s Choice and Beautycounter, but each of these brands have their own, differentiated positioning: one was acquired by a strategic, and the other a financial sponsor. As such, it is likely that the evident differences in the businesses, the buyers, and deal dynamics led to different valuation profiles, all being great outcomes that will be interesting to continue to track going forward.

Rich Gersten: They reinforce the attractiveness of all aspects of the beauty space (e.g., DTC, clean, direct selling, contract manufacturing, etc.). Carlyle’s acquisition of Beautycounter was the only PE deal; the others were strategic acquisitions that may have filled a hole or met a need for the acquiror. Unilever has continued to be active on the beauty and wellness side (prestige and mass). THG is clearly looking to vertically integrate as it has done in other transactions historically.

William Susman: Very aware of each of these deals and each has its own dynamic. I know that Carlyle saw in Beautycounter a true founder-led brand with real customer engagement. In the case of Beautycounter, the distribution format or go-to-market strategy was the ends, not the means. The means was the brand itself.

Marissa Lepor: These deals reflect investors’ pursuit of strategic value-add assets. Both Paula’s Choice and Beautycounter are incredible industry-leading businesses, each with a strong brand heritage of authenticity and transparency, ingredient-driven and scientifically tested formulations, and primarily direct-to-consumer business models. Both brands have been advocates of safe ingredients and formulations long before it was trendy—Beautycounter has even taken its advocacy beyond its own brand and products, passing nine pieces of legislation to advance personal care product safety in the United States. THG’s acquisition of Bentley Labs had a slightly different motive—Bentley will allow THG to further expand its beauty manufacturing and product development capabilities, further establishing THG as an industry leader in the digital beauty industry.

For more in depth analysis get the full Beauty Deals: Investment and M&A Transactions Q2 2021

Rumors of a Paula’s Choice sale or IPO have been circulating for years. What do you think tipped the scale to make it such a desirable target for Unilever?

Jeff Mills: Paula’s Choice is a very on-trend–positioned brand, which has noteworthy scale, global reach, significant data on its consumer behavior, unique technologies, and is on the cutting edge of the emerging personalization trends. The brand focuses on clinical efficacy at an affordable price point, creating a strong value proposition for consumers, who are increasingly gravitating towards products with active ingredients that have notable results.

Rich Gersten: The brand represents a rare scale asset worthy of a strategic buyer’s interest. For Unilever, Paula’s Choice brings them a digitally savvy brand (especially on TikTok), a strong Amazon and DTC presence, increasing success, and an ingredient and transparency focus for a slightly younger demographic and the recently launched Sephora partnership as an anchor retail partner to complement its strong DTC business. The brand is also resonating globally.

Are the Beautycounter and Paula’s Choice deals a harbinger of more billion-dollar-plus deals to come?

Jeff Mills: The significant size of both Beautycounter and Paula’s Choice also made both of these businesses very attractive as independent brands of this size are scarce in this industry. There are very few brands that have not yet been acquired or gone public of this size, and the proliferation and low barriers to entry for new emerging brands entering the space will continue to make it more challenging for brands to hit this level of scale. That said, with valuations climbing and a handful of very attractive brands on track to scale, we expect that there will continue to be large transactions in the coming years.

Rich Gersten: I think deals of that scale are few and far between. It will be interesting to see if the SPACs focused on the space are able to find deals of that size.

William Susman: Yes. For sure.

Marissa Lepor: With $1.9 trillion of dry powder globally, investors are increasingly competing for the best assets, driving up valuations of industry-disrupting businesses with strong and authentic brand stories, engaged consumers, and robust financial profiles. These assets continue to command unprecedented valuations and, as long as best-in-class brands continue to innovate, engage with, and expand their loyal fan base and scale profitably, more billion-dollar valuations are likely on the horizon.

What made Bentley so attractive to THG Ingenuity (given the ubiquity of labs in the US)?

Jeff Mills: We believe that THG found that having a business that is based in the US with in-house innovation and R&D capabilities that can support its brands and help it provide further capabilities to brands it sells through its channels was an attractive business proposition. It also further diversified and added new capabilities to THG’s continuously growing platform.

SPACS have provided traditional buyout targets more opportunity and a quicker route to capital. What’s your opinion on SPACs? Are they here to stay? Will the SPAC bubble continue to float or is it ready to burst?

Jeff Mills: SPACS are an interesting alternative and can’t be ignored, but there are some challenges with SPACS that are worth noting. The shorter duration of SPACS (2 years vs. 10 years for a traditional fund) can create more pressure to complete acquisitions, which can lead to paying high valuations and thus forcing companies to accelerate growth to unsustainable levels. SPACs also circumvent many of the traditional rules and protections of traditional IPOs (being allowed to show forward projections, for example); this has led to increasing scrutiny from the SEC, which may temper the market.

Kelly McPhilliamy: Over the past few years, the record level of SPAC formation has brought this alternative into consideration for sellers alongside M&A and IPOs. However, the SPAC market has come under some pressure recently because of calls for greater regulatory scrutiny (on disclosures, diligence, accounting, etc.). Another source of pressure is the drying up of the PIPE [private investment in public equity] market, which had been investing in SPAC transactions and providing additional capital to companies or liquidity to shareholders. While these changes have slowed the pace of deals, SPACs may still be a viable alternative to M&A or an IPO.

Rich Gersten: I think it is a bubble and I am not sure they make sense at all for beauty and personal care brands. SPACs require a scale asset to de-SPAC and there are just not that many scale assets. SPACs will also be competing against strategic buyers for assets and the SPACS will have less to bring to the table than strategic buyers. Mono-brand companies also do not perform well in the public markets, so the SPACs will also be forced to continue an M&A strategy after they de-SPAC to grow. All this bodes well for sellers of beauty brands as there are now more strategic buyers than at any time before.

William Susman: SPACs are having a moment—and a good one at that. I am skeptical of their longevity, as one bad apple can spoil the whole bunch. Many of the deals have been successful to date but, for beauty, the biggest issue will be size.

Ilya Seglin: I’m very skeptical of SPACs continuing to stay relevant for the beauty sector. One issue is the size requirement (how many billion-dollar opportunities in beauty are out there?). Another is the brand’s ability to manage its business as a public company—very hard to do, especially as a mono brand.

Marissa Lepor: For the right business at the right time in its growth trajectory, selling to a SPAC can be an excellent and lucrative exit strategy. As such, SPACs continue to receive a lot of hype, but it’s important to evaluate each opportunity on a case-by-case basis. Investors sometimes have a “herd mentality” when it comes to trends in the finance world, and SPACs have definitely been an industry darling for a while. Naturally, the businesses with the best brands, infrastructures, and management teams will continue to be industry leaders, regardless of whether they operate privately or sell to a private equity firm, SPAC, or strategic buyer.

A year ago, everyone was buzzing about Amazon being an important data point for evaluating a brand’s strength and equity in the marketplace. Is the Amazon factor still as important as it was a year ago?

Jeff Mills: Amazon continues to be important, as almost half of product shopping searches start on Amazon today (46% per CivicScience 2021 study). That being said, increasing digital penetration during COVID-19 has benefited direct e-commerce sites as well, and strong website purchasing trends / DTC presence is equally as important to show a brand can drive traffic direct to its site and leverage data collection capabilities to glean important consumer trends & insights. We have seen brand presence on Amazon support reductions in pricing / brand equity erosion driven by illegal resale on Amazon, and it is definitely a positive to see a brand that has developed their Amazon presence, however small, to ensure “discoverability” and control on a platform that drives such significant traffic.

Kelly McPhilliamy: With 200 million Prime members, Amazon continues to be an important channel for beauty. According to eMarketer, it represents over one-third of all online beauty sales. Coupled with the introductions of its professional beauty and luxury beauty stores in 2019 and 2020, respectively, Amazon is attracting more premium brands. We rarely talk with a brand that doesn’t think about Amazon as a critical component of their distribution strategy, and the sales data can help inform a brand’s strengths and opportunities.

Rich Gersten: I view Amazon as another viable distribution channel that can complement a brand’s existing distribution strategy. COVID certainly accelerated the adoption of Amazon for both consumers and brands alike in beauty. While I believe it makes sense for brands to consider Amazon in their strategy, I tend to advise brands to pursue it after some brand awareness has been built and to consider the impact, if any, to their existing retail partners.

Ilya Seglin: I think we have returned to a more balanced view again—assessing the importance of Amazon vs. the brand’s maturation. Amazon is great for growing sales (although at an increasing cost) but not great for brand building. Investors, however, care about both—the brand value as well as the scale. So, it’s a delicate dance a brand has to do to increase the value of both.

Marissa Lepor: For certain businesses, a carefully crafted Amazon strategy can expand brand awareness and drive sales, both on Amazon and through a company’s proprietary website. From my experience, the brands that succeed at Amazon have searchable, solution-driven products and/or key ingredients, establish a “seller-central” relationship (as opposed to “vendor central”), and have ritualistic products that are used often and require replenishment. Some brands feature select SKUs on Amazon and use the site as a discovery platform, encouraging customers to visit their proprietary sites for access to the full collection. Lastly, because of Amazon Prime, customers are often more inclined to make impulse purchases on Amazon, especially if purchasing one or two products on a company’s proprietary site wouldn’t meet free shipping thresholds, further underscoring the discovery nature of the Amazon platform.

International distribution—in particular success in China—has become an important factor in evaluating a brand. How does international distribution play into valuation? Has it become mandatory for a brand to have demonstrated success in markets like China to command a valuation premium?

Jeff Mills: Demonstrated success is less important, as it could present a tangible opportunity to be capitalized upon going forward for investors and buyers during the next phase of ownership. That said, because of the size and premium nature of the Chinese market, it’s imperative that companies have a viewpoint on how they plan to reach this important audience in an authentic way that aligns with their values, and that companies have the capability to execute on international distribution at the right time in the company’s life cycle. It’s also important that brands can appeal in other international markets, beyond China, particularly in large, non-Western markets. Value propositions must resonate with a broad audience that extends outside of the US.

Kelly McPhilliamy: Expanding into China is a top priority for the major Western strategic buyers, so it can be a meaningful value driver for beauty brands. Plus, Asian strategics are seeking Western brands with the potential to grow by multiple factors of their current size. While most indie brands enter the market through cross-border e-commerce, the opportunity for strategics is to tap their in-country e-commerce and retail networks to accelerate growth. We don’t see strong international distribution as mandatory, though, as there are other ways to demonstrate Chinese consumer demand—such as through social media engagement with the brand, travel retail sales, performance in gateway cities, and market testing.

Rich Gersten: This largely depends on what stage you are investing. For earlier-stage investing, such as what True Beauty Ventures does, China is less important to the near term and more important to the long term. If you are seeking a strategic exit, then demonstrated success in the market should drive interest and valuation. International distribution can play into valuation if a brand has demonstrated success in the markets abroad, but not necessarily full exploitation of the opportunity realized.

William Susman: International distribution only enhances valuation. Brands that can demonstrate global appeal will garner a higher valuation.

Most businesses globally continue to struggle with supply-chain issues with experts saying it could take 24 months to work through the challenges. What do brands need to be thinking about to future-proof their brands to attract capital or in preparation for an exit?

Jeff Mills: Inventory demand planning is a significant priority in terms of capabilities in this industry— it is important for growing brands to keep up distribution and productivity expansion at retail to continue to build brand recognition and loyalty among consumers, which means they must be able to manage inventory, keep product in stock, and launch new products. A brand that can adequately plan for supply-chain delays has a competitive advantage in this market and will be better positioned for success with retailer partners looking to continue to fill their shelves. Main Post Partners’ partner companies are installing the people and investing in the technology needed to ensure advanced and accurate inventory order placement, while optimizing for increasing costs associated with freight and raw materials.

Rich Gersten: Brands should not under-resource the supply-chain function early on. It is critical to scaling profitably and maintaining momentum. A broken supply chain can result in less investor interest. It can also result in liquidity challenges if not managed properly, which can be catastrophic for small brands. I would encourage brands to ensure they have a strong 3PL partner that can scale with them (e.g., meeting the needs of both e-commerce and wholesale distribution), make sure they have backups for key contract manufacturers and labs, and limit complexity of product assortment where possible.

How important are a brand’s ESG (environment, social + governance) initiatives when evaluating an investment target, and what do you look for?

Jeff Mills: Very important in all industries but particularly so in consumer, given consumers’ demand for transparency and brands/companies that align with their lifestyle and values. We must shift our focus from just “shareholders” to all “stakeholders”—employees, supply-chain partners, carbon footprint etc. Brands have a responsibility to all stakeholders, and as investors we want to encourage and seek out companies that take this seriously. Not only is it where the world is headed, which makes for a smart investment, it is the right thing to do.

Rich Gersten: At True Beauty Ventures, some of our core criteria are focused on sustainability, mission-driven brands, ethical founders, and positive company culture. The beauty industry, as a whole, is working on improving the sustainability piece and customers are increasingly looking for that from their brands, so we would expect our brands to be on a similar path if not already at a higher standard. While we have a detailed list of additional criteria, at the end of the day, we are looking to partner with good people. These people must have strong and authentic relationships with their employees, suppliers, customers, investors, etc., and proper transparency and governance in place to ensure the criteria is continuously being met.

Ilya Seglin: There is no question that not only does the consumer increasingly care about brands’ positions and actions on social issues, but so do employees. So, it’s become an important element of simply running a beauty business (just ask any beauty CEO off the record!). But any initiative has to be relevant for the brand, the founder, and the brand’s audience. Too many brands are simply virtue signaling, and consumers and employees are sophisticated enough to see through that.

There is a lot of talk about inflation and tax policy changes in the US. We’ve also started to see price increases of 5-10% down the value chain from packaging and ingredient suppliers. Any insight on the impact in the near and long term from these economic pressures?

Jeff Mills: Tax changes have definitely motivated business owners to consider an exit and puts pressure on transaction dynamics to close on specific timelines. We’ve seen a sharp increase in deal flow, and getting something done before year end is of paramount importance. Inflation is everywhere. From what we have heard and seen, most brands are evaluating or taking price increases and there has been little to no pushback (from consumers, retailers, customers, etc.). Being thoughtful about pricing in this environment is critical. That said, cost pressure is challenging for low-margin businesses with little pricing power (e.g., commodity-like products, non-value-add distributors). For businesses with these characteristics and low margins, they compete on price, which takes time to move, and margins are impacted materially. Conversely, companies with true competitive moats and differentiated products and services are able to pass on price increases to consumers / end users and margins are relatively unaffected. Businesses with previously high R&D (e.g., DDG) and high fixed investments (e.g., Fortis) can perform well by capitalizing on a (inflation-adjusted) lower investment/cost basis.

Rich Gersten: Inflation could have a real short-term impact on product COGS and could pressure margins or force brands to raise prices. COVID relief and other tax credits etc. could stimulate demand for certain consumers. Not sure either will have a material impact on the prestige consumer, although more moderately priced brands are definitely having more success at this time, particularly with the Gen Z consumer. While I believe consumers overall have become a bit more price sensitive over the past year, they are still willing to pay for brands that earn their trust and deliver meaningful value through proven product results and positive customer experiences.

William Susman: It’s still early to be able to tell the impact of these economic pressures. Some of the price increases we’re seeing were long overdue and reflect “catching up.”

Ilya Seglin: The good news—beauty margins are some of the best in the consumer space. The bad news—it’s one of the most crowded and competitive categories in the consumer space. So, most brands will not be able to raise pricing to compensate for higher input and labor costs and margins will get squeezed for many.