In one month, the beauty world saw one well-known brand sell for $1 billion, while two other well-known brands shut down. What happened highlights a truth that few in our industry say out loud: Who the brand’s founder is often matters more than what the brand’s products do.

According to new data from Business of Fashion and McKinsey, 39% of consumers say product performance drives purchase decisions, while only 13% care about the founder. And yet—e.l.f. Beauty’s most recent $1 billion acquisition went to a founder with a strong celebrity platform. That same month, Ami Colé and Youthforia—both with innovative formulas, proven customer demand, and industry accolades—announced they were shutting down.

If you’re building a brand without understanding why this happened, you may be playing the wrong game. And in start-ups, this can mean the end of even the most promising ideas.

The Traditional PMF Scorecard—And Its Limits

For decades, Product–Market Fit (PMF) has been the holy grail of start-up success. Venture capitalist Marc Andreessen coined the term. Every accelerator preaches it. Investors swear they evaluate it. The promise is simple: Build something people want, find your market, achieve PMF, and win.

But the beauty industry just served up three back-to-back case studies that reveal PMF alone isn’t enough.

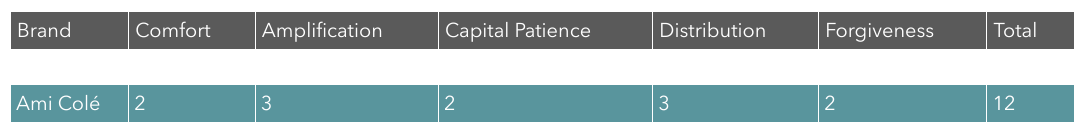

Case 1: Ami Colé—The Gold Standard That Still Shut Down

Founder: Diarrha N’Diaye-Mbaye, a former Glossier and L’Oréal executive, built Ami Colé to finally serve consumers of color overlooked by mainstream beauty. With Senegalese heritage and deep brand-side experience, she embodied authenticity and credibility.

The Product-Market Fit Snapshot

Traditional Product-Market Fit Score: A+

Outcome: Complete shutdown (Sept. 2025)

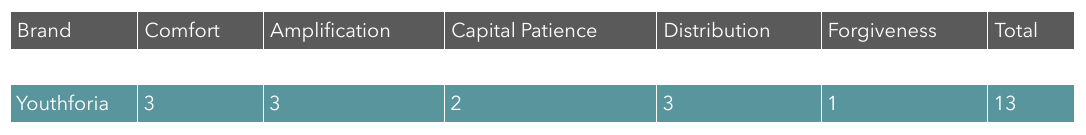

Case 2: Youthforia—Innovation That Couldn’t Survive a Mistake

Founder: Fiona Co Chan, an Asian American entrepreneur who broke into beauty through TikTok and Shark Tank. With no legacy beauty background, she positioned herself as the scrappy innovator who could move fast and speak Gen Z’s language.

Product-Market Fit Snapshot

Traditional Product-Market Fit Score: A

Outcome: After the foundation controversy erupted in May 2024, Youthforia tried to respond and repair its reputation. Despite efforts to recover, the brand closed in August 2025.

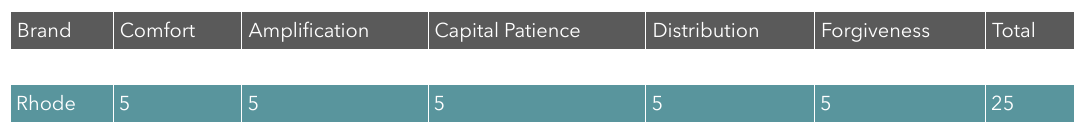

Case 3: Rhode—A PMF Outlier That Rewrote the Scoreboard

Founder: Hailey Bieber, a global celebrity with 50M+ followers and a permanent place in the fashion-beauty ecosystem. Married to Justin Bieber and already a cultural symbol, she brought built-in industry comfort, investor trust, and media dominance.

Product-Market Fit Snapshot

Outcome: $1B acquisition by e.l.f. Beauty (May 2025)

On paper, rhode’s path looked less obvious through the Product-Market Fit lens. But celebrity Hailey Bieber’s alignment with industry expectations gave Rhode outsized advantages when it came to a more important scorecard: Founder-Market Fit.

Product-Market Fit wins customers. Founder-Market Fit wins billion-dollar exits.

The Real Scorecard: Founder–Market Fit

Founder-Market Fit can feel like a fuzzy thing to define. It’s based on a person, and it can involve a lot of less traditionally quantifiable factors like feelings and influence.

So for those of us trying to play the game, here are the rules.

Founder-Market Fit measures how well a founder’s identity, network, and positioning align with the comfort zones of the industry’s power brokers—the people who control capital, distribution, and acquisition decisions. And here's how to measure it:

The Founder-Market Index

1. Industry Comfort Level—Do you feel like a “known quantity” to the insiders?

2. Built-in Amplification—Celebrity status, existing audience, media relationships

3. Capital Patience—Family wealth or investors who will wait years, not quarters

4. Distribution Advantage—How easily can you get shelf space and partnerships?

5. Forgiveness Score—How many mistakes will you survive before you’re written off?

So, how did our three beauty brands score?

FMF Scores for the Three Brands

Despite strong insider experience, N’Diaye-Mbaye didn’t come in with celebrity amplification or generational capital. Investors had less patience, and industry insiders extended less forgiveness when headwinds hit.

Founder Co Chan excelled at viral amplification but lacked deep investor patience and legacy industry networks. When the crisis hit, the industry didn’t extend the same patience or insulation to Co Chan as it did to more familiar founders.

Bieber’s celebrity status maximized every FMF dimension: comfort, amplification, patient capital, distribution, and especially forgiveness. When Rhode faced a trademark lawsuit just days after launch from an existing fashion brand with prior rights to the name, the controversy barely slowed their momentum—a legal challenge that might have killed a lesser-known founder's brand. The brand had very good products, and the whole team brought incredible creativity and business acumen—but her Founder-Market Fit score was a decisive factor that unlocked billion-dollar scale.

This Isn’t Just Beauty

The Founder-Market Fit dynamic shows up in every industry:

Different industries, same game: Innovation is often undervalued, while familiarity is rewarded.

The Founder-Market Fit Optimization Playbook

You can’t change who you are. Not all founders are celebrities, influencers, or industry insiders. But you can change your Founder-Market Fit score.

Why This Should Keep Leaders up at Night

Consumer surveys say people want quality products. But the industry often rewards familiarity, comfort, and amplification over pure innovation. The cost? Breakthrough ideas risk dying too soon. Capital flows toward the most comfortable founders. Underserved communities lose out.

The Bottom Line

Rhode’s success illustrates how Founder-Market Fit can rewrite the rules of the game. Ami Colé and Youthforia show what happens when Product-Market Fit is strong, but Founder-Market Fit support is limited. Together, these brands prove that measuring both Product-Market Fit and Founder-Market Fit is the only way to understand who wins, who struggles, and why.

Until both scorecards are part of the conversation, innovation will remain underfunded, and billion-dollar exits will continue to favor those who feel most familiar to the industry’s gatekeepers.